Foreign exchange, commonly known as Forex, is one of the most traded markets in the world. An understanding of the optimal Forex trading times across different markets can be a key determinant of success for any trader. Navigating the 24-hour global marketplace may seem daunting, but with a thoughtful inspection of trading sessions, market volatility, potential impacts of economic announcements, and strategic adjustments to align with these factors, one can significantly enhance their trading prospects. This article serves to shed light on these factors, thereby broadening your understanding of when to strike the Forex market for maximum profitability.

Understanding Forex Market Hours

Understanding Forex Market Hours

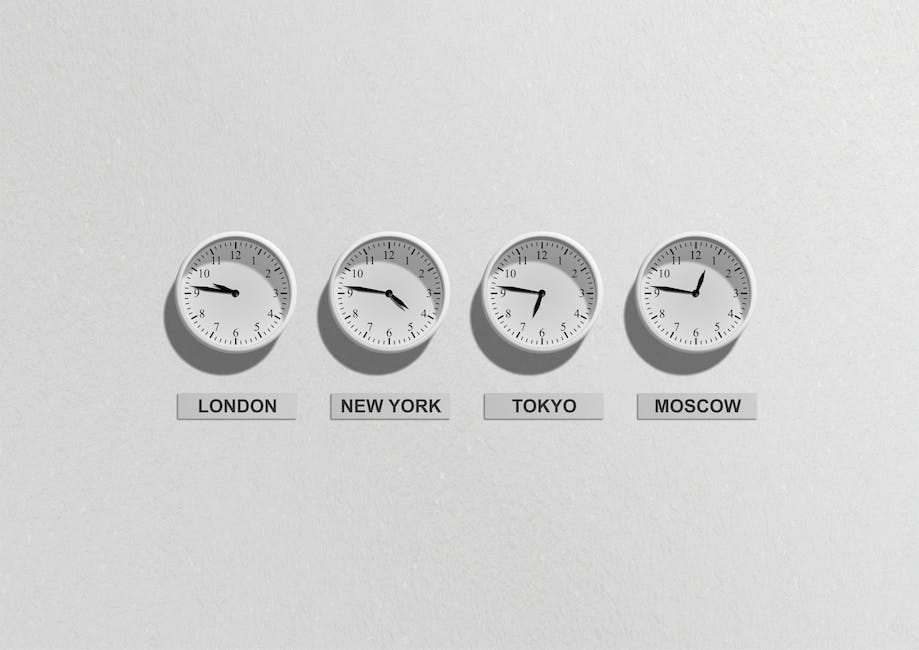

Forex market, also known as foreign exchange market, operates 24 hours a day, five days a week. This round-the-clock operation is due to the functioning of the global financial centers in different time zones. Worldwide, the primary forex markets are located in Sydney, Tokyo, London, and New York.

Trading Sessions of Forex Market

Different forex markets operate at different time zones, leading to the concept of Forex trading sessions. Each of the four primary markets functions in their local time, causing the Forex market to never sleep virtually. The Sydney market in Australia opens first, followed by the Tokyo market in Japan. The London market in the United Kingdom opens next, overlapping with the Tokyo market’s closing hours. Lastly, the New York market in the United States opens, overlapping with the London market’s closing hours.

Understanding the function and timetable of each market is crucial because the level of market activity during different session times can impact the liquidity, volatility, and price trends of currency pairs.

Trading Overlaps

Trading overlaps occur when two markets operate simultaneously. The most significant overlaps occur between London and New York markets and between London and Tokyo markets. Overlaps create a higher than usual trading volume, which increases the volatility and liquidity of currency pairs. These periods of overlaps are considered the best times for Forex trading, as higher volatility can present more trading opportunities.

During the London and New York overlap, which occurs from 8:00 am to 12:00 pm EST, there is the highest level of liquidity. This is the best time for trading the major currency pairs, like EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

Meanwhile, the London and Tokyo overlap, from 3:00 am to 4:00 am EST, provides a less liquid, more volatile trading environment. This can still be an optimal time for trading certain Asian currencies like JPY, AUD, and NZD.

Peak Activity Times

In addition to overlaps. Trading volumes also spike during the first hour after a major market opens and after major economic or news events. These events often cause large forex price moves, making them ideal times to enter or exit trades.

However, high volatility isn’t suitable for all traders, especially those with a lower risk tolerance. These traders might perceive less volatile market hours when there’s a steady trend as the best trading times.

Understanding the intricacies of the Forex market is crucial to successful trading. The optimal times to engage in trading largely varies depending on the currency pair a trader is specializing in, their trading strategies, and their level of risk tolerance. The Forex market operates round the clock, nonetheless, careful consideration should be given to market dynamics during certain time frames as not all hours are equally profitable for trading.

This is due to the cyclical nature of Forex market sessions and a profound knowledge of the Forex market hours can drastically improve your chances for a better return on investments. However, although the 24/7 availability of the market is appealing, it doesn’t necessarily mean that profitable opportunities are constantly available throughout the day. Recognizing the right times to engage is a fundamental component to successful trading.

Relation between Forex Market Volatility and Trading Times

The Implication of Forex Market Volatility on Trading Times

The characteristics of the Forex market can be influenced by various factors such as economic indicators, geopolitical events, and market sentiment, leading to volatility in foreign exchange rates. This volatile nature can make Forex trading risky, but at the same time, it presents potential profitable opportunities.

Timing is indeed an essential factor in maximizing returns on the Forex market, which operates 24 hours a day. However, certain times tend to be more beneficial to traders. Major geographical Forex sessions such as Sydney, Tokyo, London, and New York have certain overlapping hours that usually create high-volume trading periods. These periods of high-volume trading result in increased market volatility, providing more opportunities for traders. It’s during these overlapping sessions that most traders typically seize the opportunity to make trades.

Peak Trading Hours and Market Volatility

The forex market sees its peak volatility during the two hours that the London and New York markets overlap, which is from 12:00 to 16:00 GMT. This is when most of the world’s largest banks and financial institutions are active, causing higher trading volumes and moments of high volatility.

The London session alone, which begins at 08:00 GMT and ends at 16:00 GMT, is also a peak trading period. This is due to the fact that London accounts for around 43% of all forex transactions.

The two-hour window when the Tokyo and Sydney sessions overlap, which is between 23:00 and 01:00 GMT, is another period of heightened activity. At this time, many Asian corporations and banks are active in the market.

Strategies for Trading During Peak Hours

Understanding the relationship between forex market volatility and trading times can be leveraged in various trading strategies. For instance, day traders thrive on volatility. They seize the small fluctuations in currency rates in the high-volume trading hours to make quick profits.

Swing traders, on the other hand, may hold their positions open for several days, aiming to profit from the bigger trends and swings in the market. The increased volatility during peak hours can be advantageous for swing trading, as it offers a greater chance for their trades to reach their profit targets.

While volatility can yield substantial profits, traders must also be aware of the increased risk involved. Therefore, it is crucial to have effective risk management strategies in place. These could include setting stop-loss orders, keeping trade sizes reasonable, and being aware of economic and geopolitical events that could impact market volatility.

Understanding when the forex market is at its busiest and grasping how these periods influence market volatility is crucial for effective trading. It allows traders to pinpoint lucrative trading opportunities and manage potential risks more effectively. Essentially, it revolves around comprehending and monitoring market movement and strategically utilizing this information with the goal of maximizing profitability and minimizing losses.

Best Days of the Week for Forex Trading

Forex Trading: The Peak Hours

The most active hours for forex trading differ based on the currency pairs a trader decides to focus on. Although the Forex market is open 24 hours a day from Monday to Friday, the most substantial trading volumes and movements typically coincide with the opening hours of the London and New York forex markets.

The operation hours for the London market are from 3:00 a.m. to 12:00 p.m. EST, and for the New York market, they are from 8:00 a.m. to 5:00 p.m. EST. The convergence of these two sessions sees high trade volumes, making the period from 8:00 a.m. to 12:00 p.m. EST a potentially profitable trading window for those well-versed in market dynamics.

Best Days of the Week for Forex Trading

Forex trading can result in profitable investments or losses depending on several factors. One of those factors is the day of the week. While Forex markets are open 24/5, not all trading days are equal. Generally, midweek trades tend to show a higher level of volatility and liquidity.

Tuesday, Wednesday, and Thursday are considered to be the best days for Forex trading due to the high volatility associated with these days. The reason for this activity is that more macroeconomic data is released midweek, which can cause drastic price movements. Fridays can also be suitable for trading, but it can be riskier due to traders closing positions before the weekend.

Forex Trading and Economic Releases

Economic releases, central bank announcements, and geopolitical events can have a significant impact on the Forex market. The main ones include GDP reports, employment data, interest rate decisions, and consumer price index data. These tend to be released on specific days and can cause high volatility, mainly if the data deviates significantly from expectations.

For instance, the Non-Farm Payrolls report in the U.S. is typically released on the first Friday of each month and can cause dramatic movements in pairs involving the U.S. dollar. A smart trader, therefore, needs to keep track of such releases because they create trading opportunities.

Maximizing Potential with Forex Trading Times

In order to take advantage of your Forex trades to the fullest degree, it’s vital to make your transactions during periods of peak activity. For instance, if the EUR/USD pair are the currencies you’re dealing with, your best times to trade would be during the New York and London sessions, as these time periods yield the most significant movements. However, if you’re dealing with the AUD/USD pair, the Sydney and New York trading sessions would likely prove the most beneficial due to their high level of activity.

To wrap it up, it’s essential to have an understanding of the optimal times and days for trading in the Forex market. This involves an awareness of specific economic events and a strategic approach to trading during the market’s busiest hours.

Impact of Economic Announcements on Forex Market

The Influence of Economic Announcements on the Forex Market

Economic announcements and news releases bear a significant influence on the forex market, with a substantial capacity to drive currency values and provide lucrative trading opportunities. The health of a nation’s economy, which is the primary influencer of currency rates in the foreign exchange market, can be gauged based on a series of economic indicators. These indicators generally come in the form of macroeconomic announcements, distributed through monthly or quarterly reports.

Several factors, such as changes in interest rates, variations in unemployment data, consumer price index (CPI), gross domestic product (GDP), retail sales figures, trade balance data, and others, have a direct impact on a country’s currency value in the forex market. As this data becomes public, it triggers volatility and shifts in currency rates. Traders can leverage this information to predict potential market movements and strategize their trades accordingly.

The Importance of Economic Calendars in Forex Trading

An economic calendar is a critical tool for forex traders, providing detailed schedules of economic announcements from different countries. By tracking major economic events, traders are able to anticipate drastic movements in the market that come as a direct result of these releases.

The economic calendar indicates the date and time of the news release, the concerned country, the importance of the news (usually marked with “bulls”), the previous data, the economic forecast, and the actual data once it is published.

Best Time for Forex Trading Based on Economic Announcements

Forex traders understand that timing is everything. The best time for trading based on economic announcements is usually the period just before the release of the news. The period after the announcement can also be profitable, especially if the actual data deviates significantly from the forecast.

Some traders choose to anticipate the news and open positions beforehand, hoping that the forecast will be accurate. Others wait until the actual announcement is released to confirm whether their predictions are correct. Both strategies have their risks and rewards and depend largely on the individual trader’s ability to predict economic trends and their appetite for risk.

During the release of key economic indicators, forex markets can experience high volatility. Therefore trading during these times requires comprehensive market knowledge and a sound risk management strategy. Traders also need to be prepared for possible “slippage” during these periods, as rapid price movements may lead to execution at a different price than expected.

It’s important to remember that while smart timing of your trades, especially around significant economic announcements, can bolster your potential to profit, this method also presents substantial risks. Remaining abreast of the latest market developments, comprehending the impact of economic data, and adhering to a disciplined trading tactic are key strategies to successfully navigate the dynamic and often unpredictable realm of forex trading.

Strategic Adjustment of Trading Times

Deciphering Forex Trading Schedules

Forex trading, an abbreviated term for foreign exchange trading, is accessible 24 hours a day, five days a week. This continuous availability opens up a vast spectrum of possibilities for traders across a multitude of time zones to engage in the worldwide Forex market. However, it’s important to note that not all trading hours are marked by the same levels of activity or fluidity. Hours of pronounced activity typically coincide with the operational hours of major financial hubs like London, New York, and Tokyo, which are the epicenters of high-volume global financial transactions.

Matching Trading Times to Your Profile

Strategically adjusting your trading times to match your trading style and risk profile is an important practice in Forex trading. Some traders prefer high volatility periods, which provide opportunities for large, quick profits but come with higher risk. These traders may find the overlap between New York and London trading hours, typically between 8.00 am to 12.00 pm EST, advantageous as these are periods of high volatility. On the other hand, risk-averse traders that prefer less volatility may opt to trade during less active hours.

Currency Pair Considerations

Each currency pair has its peak activity period, generally aligning with the working hours of their respective countries. For example, currency pairs involving the Euro (EUR) are typically most active during the London trading hours. Likewise, the USD/JPY pair sees the most activity during Tokyo’s trading hours. Therefore, understanding the most active trading periods of your preferred currency pairs can enhance your potential profitability.

Aligning with Forex Market Activity

To maximize profitability, traders should align their trading schedule with high-activity periods in the Forex market. As previously mentioned, the Forex market sees the highest volumes of trading when the London and New York markets overlap, but other periods also see substantial activity. For example, the Sydney and Tokyo markets overlap between 7.00 pm and 2.00 am EST, and while not as volatile as the London/New York overlap, these hours still present viable trading opportunities, particularly for those trading Australian and Asian currency pairs.

Consistency in Trading Times

Lastly, consistency in your trading times can also be beneficial. Consistency allows you to streamline your analysis by focusing on specific market behavior during your trading time. This way, you can study repeated patterns or trends during these hours, creating a more informed strategy for future trades.

Remember, while these guidelines can significantly contribute to your Forex trading strategy, every trader’s circumstances and preferences are unique. Therefore, flexibility and ongoing assessment should be a part of your approach to strategically adjust trading times in the Forex market.

With a nuanced understanding of trading times and their relationship with market volatility, along with a comprehensive grasp of how certain days and economic announcements can benefit Forex trading, a trader is well-equipped to strategically adjust their trading schedule. It is crucial to remember that the effectiveness of a Forex trading schedule ties in deeply with the currency pair being traded, and individual trading style and risk profile. Therefore, in the multifaceted world of Forex trading, it is pivotal to harmonize market knowledge with personal trading methodology to maximize profitability. Remember, knowledge is power and in the rapidly gyrating Forex marketplace, power translates directly to profits.