Forex Trading for Beginners: A Comprehensive Guide.

Delving into the world of forex trading can seem like a daunting task. The compendium of unfamiliar terms and the incessant flow of data might initially make you step back. However, forex trading is an exciting venture that has the potential to bring in substantial rewards, and it’s not as complex as you might think! The first step is to understand the basics. This begins with fundamental concepts like the different currency pairs, forex market hours, sessions, and essential terminologies like pips, leverage, and margins. Also, getting to grips with the different types of market analysis – fundamental and technical – is crucial. Understanding these rudiments will take you a step further to comprehending the larger picture.

Understanding the Basics of Forex Trading

Understanding Basic Concepts of Forex Trading

Forex trading, also known as foreign exchange or currency trading, means buying, selling and exchanging currencies at current or predetermined prices. This market functions in pairs, meaning that you always trade one currency against another. When referring to trading pairs, the first currency listed is the base currency, and the second is the quote currency. An example of this is EUR/USD: here, EUR is the base currency and you are speculating on whether it will rise or fall against the USD.

Learning about Different Currency Pairs

Forex trading always involves a currency pair rather than a single currency. The reason is that the value of a currency is relative and can only be measured against another currency. There are three types of currency pairs: Major pairs (most traded, includes EUR/USD, USD/JPY, GBP/USD), Minor pairs (less liquidity, includes EUR/GBP, EUR/AUD) and Exotic pairs (low liquidity, high risk, includes USD/SGD, EUR/ZAR).

Forex Market Hours and Sessions

Understanding forex hours and sessions can help you strategize your trading efforts. The forex market operates 24 hours a day, five days a week, due to the difference in time zones and trading sessions in the world’s major financial centers. The sessions are as follows: Sydney Session, Tokyo Session, London Session, and New York Session. With this international scope, there is always a market open for trading, allowing you the freedom to trade when it’s most convenient for you.

Learning Basic Terminologies in Forex Trading

An important step when learning about forex trading is understanding its specific terminology. ‘Pips’ are the smallest price move that a given exchange rate makes, typically the fourth decimal place in most currency pairs. For example, if the GBP/USD shifts from 1.3054 to 1.3055, then the .0001 USD rise equates to one Pip.

‘Leverage’ in forex is a tool that traders use to increase the value of their trade. It allows traders to control a large amount of money using very little of their own and borrowing the rest. For instance, with a leverage ratio of 1:100, you can control $100,000 with just $1,000 of your own money.

‘Margin’ refers to the minimum amount needed to open and maintain a leveraged position. It is essentially a good faith deposit required to keep open positions. Understanding these terminologies and how they impact your trading practices is essential for successful forex trading.

Fundamental and Technical Analysis

Understanding Forex Trading: Fundamental Analysis

Forex trading requires a thorough understanding of the market and its myriad forces. One of the key methods used to analyze the forex market is Fundamental Analysis. This approach focuses on analyzing economic indicators and news events to predict currency value changes. For instance, it may include analyzing a country’s Gross Domestic Product (GDP), employment levels, political stability, inflation rates, and any other relevant economic news that may influence the value of a currency.

When using Fundamental Analysis, an important aspect to take into account is the Economic Calendar, which lists all the important economic events and news releases scheduled to take place. It specifies the date, currency involved and the predicted impact. This is vital as these events often lead to high volatility in the market. Traders who understand the potential impact can position themselves appropriately.

To effectively employ Fundamental Analysis, traders must stay up-to-date with global economic news and understand how these events impact different currency pairs. Moreover, understanding the role of central banks in influencing currency values becomes essential, as announcements about changes in interest rates or monetary policy can have a significant impact on the forex market.

Understanding Forex Trading: Technical Analysis

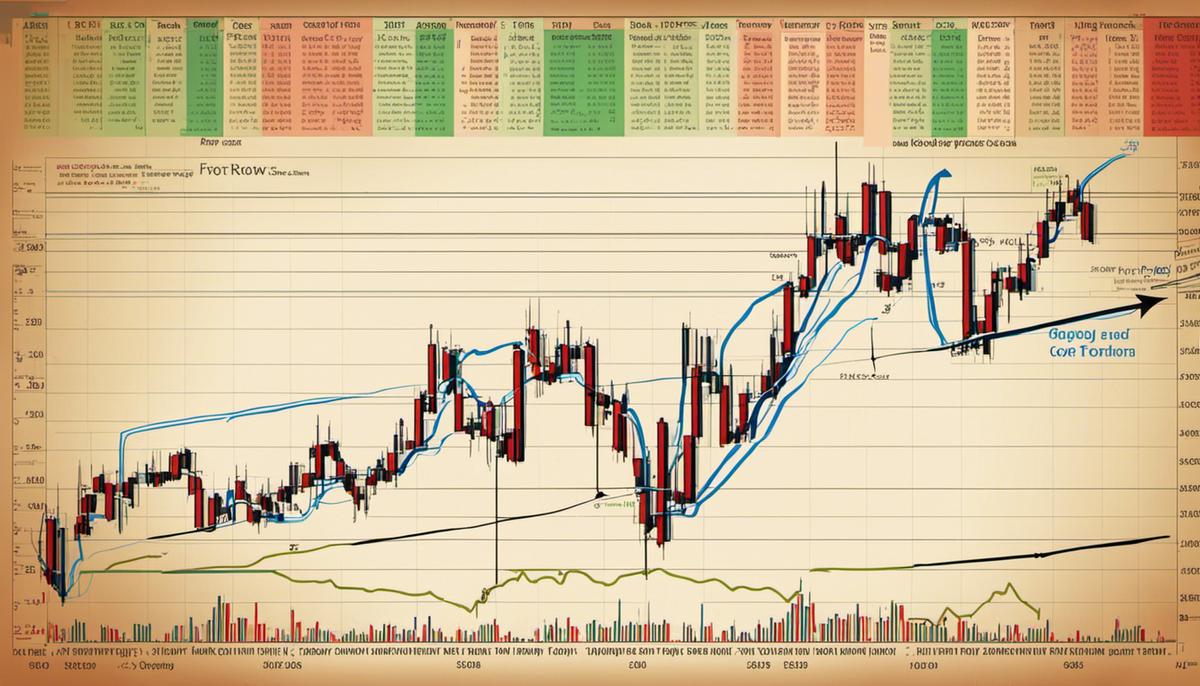

The second major method used to analyze forex markets is Technical Analysis. This is a method that uses past price movements to predict future price trends. Traders using this methods study price charts and patterns, employing various analytical tools to identify trends and decisions.

Technical analysis involves studying various chart patterns and indicators. Examples of these include but are not limited to, candlestick patterns, moving averages, and oscillators. Each of these tools provides different insights into market behavior. For instance, moving averages can provide a general idea of the market trend, while oscillators like RSI (Relative Strength Index) can help identify overbought or oversold conditions.

A key concept in technical analysis is ‘support’ and ‘resistance’. Support refers to the level at which demand is thought to be strong enough to prevent the price from falling any further. Resistance, on the other hand, is where the price is likely to face selling pressure preventing it from rising further.

One of the advantages of Technical Analysis is that it is purely based on price and volume data, eliminating the need for analysis of economic indicators or news events. However, it is recommended that traders use both Fundamental and Technical Analysis in conjunction to make well-informed trading decisions.

Remember, forex trading is complex and involves a high level of risk. Therefore, always trade with caution and never invest more than you can afford to lose.

Forex Trading Strategies

Understanding Forex Trading Strategies

Forex trading involves the buying and selling of currencies in an attempt to profit from changes in their value. There are several different forex trading strategies that traders use to maximize their profits. These include day trading, swing trading, scalping, and position trading. It’s important to understand the basics of these trading strategies as well as when to use them and the risk management techniques associated with each.

Day Trading in Forex

Day trading is a forex strategy involving making quick decisions to buy, sell, and trade currency within the span of one trading day. This strategy is ideal for those who like fast-paced trading and have a good understanding of market trends within the day. The risk management with day trading is high; it requires constantly monitoring the forex market and knowing when to cut your losses and exit a trade quickly if things don’t go as planned.

Swing Trading in Forex

Swing trading, on the other hand, involves holding trades for several days and possibly weeks aiming to benefit from the swings or changes in the market trends. Swing traders rely on technical and fundamental analysis to predict market movements. They require patience and a thorough understanding of market trends over a longer period. From a risk management point of view, a swing trader should set a stop loss level to protect their capital if the trade moves in the opposite direction.

Scalping in Forex

Scalping is a fast-paced forex trading strategy where a trader makes frequent trades throughout the day to profit from minor price changes. A trade usually lasts only a few minutes. It requires a significant time commitment and a good understanding of the short-term market fluctuations. To manage risk, scalpers use stop loss orders and limit orders to protect their trades.

Position Trading in Forex

Position trading is a long-term trading approach where a trader holds a position for weeks, months, or even years. This strategy is mostly based on fundamental analysis and it requires a solid understanding of the underlying economic factors that affect currency values. Position traders are less concerned with short-term market fluctuations and focus more on long-term trends. Risk management for position trading often involves hedging strategies, like using options contracts to limit potential losses.

By understanding these strategies and knowing when to apply them, you can optimize your forex trading efficiency. But remember, no strategy is perfect and each comes with its own risks. Therefore, it is crucial to manage your risk appropriately and make decisions that align with your financial goals.

Practice Trading on a Demo Account

Getting started with a Forex Demo Account

Before you dive into live trading, it’s crucial to invest some time practicing on a demo account. If you’re a beginner, you need not worry. Many forex brokers offer free demo accounts which let you create virtual trades using real-time market data and tools similar to a live trading account. This simulated environment will allow you to get a feel for the forex market and to test your trading strategies without risking any real money.

Setting up a Demo Account

Setting up a demo account is straightforward. Most brokers will require some basic information from you, such as your name, email address, country of residence, and phone number. Once you’ve filled out the necessary form, you’ll receive a link or download to access your demo account.

Navigating the Trading Platform

With your demo account set up, you’ll be given access to a trading platform. Each broker’s platform can vary, but commonly you’ll find tools for charting, executing trades, and tracking markets. Spend some time familiarizing yourself with these features, as it can be overwhelming when you first start.

Practicing Forex Trading

Once you’re comfortable navigating the platform, you can start practicing trading. Keep in mind that the funds in your demo account are not real, but they mimic the real-time market movements and conditions. Begin by placing some trades, experimenting with different strategies and seeing how your decisions impact your virtual portfolio.

Experimenting with Trading Strategies

A key advantage of a demo account is the freedom to experiment with different trading strategies without any financial risk. Try out different techniques and see what works or doesn’t work for you. It’s a great opportunity to fine-tune your trading plan before using it in the real world.

Realistic Trading Experience

It’s crucial to treat the demo account as if it were a real account. This means trading quantities and strategies that you would in a real forex trading scenario. By maintaining this mindset, you will get an accurate feel of the forex market.

Monitoring Demo Account Performance

While practicing trades, ensure you analyze and understand the outcomes of each trade. This will help you identify any weaknesses in your trading strategy and areas you need to improve. Using the data and statistics provided by your demo account, you can refine your strategy accordingly.

Taking the Leap to Live Trading

Once comfortable with your trading performance on the demo account, you could consider transitioning to a live trading account. But, keep in mind, the results on a demo account may not always translate directly to live trading due to emotional factors and different market conditions. It’s recommended to start live trading with a small amount of capital and gradually increase it as your confidence and experience grow.

Finally, the practical aspect of forex trading should never be underestimated. After learning fundamental concepts, types of market analysis, and different trading strategies, it’s essential to put all these theories into practice. The best way to do this is by practicing on a demo account before you dive into live trading. A demo account allows you to navigate the forex market and test your trading strategies without any real monetary risks. Remember, forex trading, like any investment avenue, involves risks. But with knowledge, practice, and careful risk management, it can open up a world of opportunities. Strap in, be patient, and enjoy the journey!