Understanding Stablecoins

Stablecoins offer a less volatile alternative to cryptocurrencies like Bitcoin and Ethereum. They achieve this by pegging their value to more stable assets, such as fiat currencies or other cryptocurrencies.

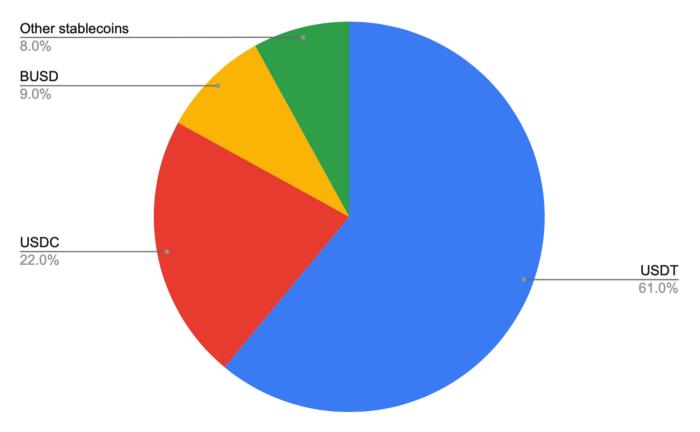

Most stablecoins are pegged to fiat currencies, particularly the US dollar. For every stablecoin in circulation, there is an equivalent amount of the pegged asset held in reserve. Tether (USDT) is a prime example, with each USDT designed to maintain a value of one US dollar.

Some stablecoins, like Dai (DAI), are backed by other cryptocurrencies. These coins are often overcollateralized, meaning the value of the backing cryptocurrency exceeds the value of the stablecoin. This provides an extra layer of security.

Algorithmic stablecoins operate differently. They use smart contracts to automatically adjust their supply based on demand, maintaining their peg through these self-regulating mechanisms.

Stablecoins serve as a bridge between traditional finance and the innovative world of decentralized finance (DeFi). They allow users to engage with DeFi applications without exposing themselves to the same level of volatility associated with other cryptocurrencies.

Benefits of Stablecoins

Stablecoins offer several key benefits in the volatile cryptocurrency market:

- Hedging tool: Their stability makes them an excellent hedging tool against market fluctuations. When the prices of other cryptocurrencies are experiencing significant ups and downs, stablecoins provide a safe haven for traders looking to preserve their portfolio's value.

- Preferred medium of exchange in DeFi: In the DeFi space, stablecoins are often the preferred medium of exchange. Their stability facilitates smoother value transfers across different platforms and services within DeFi ecosystems. Conducting trades or loans with a volatile asset like Bitcoin could introduce unnecessary complications.

- Real-world applications: Stablecoins also have promising real-world applications, especially in the realm of international transactions and remittances. Traditional remittance methods often involve high fees and slow processing times. Stablecoins can facilitate swift, cost-effective cross-border money transfers, potentially revolutionizing the financial practices of businesses dealing with international transactions.

- Streamlined trading and transactions: From an operational perspective, stablecoins streamline trading and transactions by eliminating the need for constant currency conversions. Widely accepted stablecoins like USDT provide a universal medium of exchange, allowing seamless entry into international markets without the friction of forex exchanges.

Risks and Regulation

Despite their benefits, stablecoins are not without risks. As they have gained popularity, they have attracted increased regulatory scrutiny worldwide. Governments and financial regulators are developing and implementing regulations to bring order and stability to this emerging area of finance.

The Financial Action Task Force (FATF) has expressed concerns about the potential for stablecoins to be used for money laundering and terrorist financing. In Europe, the upcoming Markets in Crypto-Assets (MiCA) bill is set to introduce a comprehensive regulatory framework for stablecoins by late 2023.

However, regulations vary significantly between jurisdictions. While some countries are moving towards stricter oversight, others are taking a more hands-off approach.

Another key risk is the stability of the assets backing these stablecoins. The value of a stablecoin is only as secure as its underlying assets. If the reserves backing a fiat-pegged stablecoin were to lose value, it could undermine the coin's stability. Similarly, algorithmic stablecoins are vulnerable to technical glitches or market anomalies that could disrupt their pegging mechanisms.

Market acceptance also poses a challenge. Mainstream adoption of stablecoins may be hindered by established norms and skepticism about this new form of money. Trust takes time to build, and the pace of adoption may not match the rapid advances in the digital landscape.

Passive Investment Strategies

Stablecoins offer opportunities for passive investment strategies that don't involve the volatility of active cryptocurrency trading.

One such strategy is "staking," where investors lock up their stablecoins for a set period to support network operations. In return, they receive additional coins as a reward. This process strengthens the network while providing a passive income stream for the investor.

Yield farming is another popular strategy in the DeFi space. Investors move their funds across various liquidity pools, seeking to maximize returns. This can involve lending or providing liquidity for currency pair exchanges. While potentially lucrative, yield farming also carries risks such as impermanent loss, where market movements can work against the investor's interests.

Lending stablecoins on various platforms is a more conservative approach. Investors can earn steady interest on their holdings, although the returns are generally lower compared to yield farming.

These passive investment strategies come with their own set of risks. Smart contracts, while generally reliable, can be vulnerable to bugs or hacks. Privacy is also a concern, as different platforms have varying levels of operational transparency.

Platforms like Aave, Compound, and MakerDao offer diverse terms and conditions for stablecoin investment. Investors should carefully review the fee structures, entry requirements, and risk management measures of each platform.

Successful stablecoin investing requires a combination of structured strategies and adaptability to prevailing economic conditions. It's a constantly evolving landscape that demands both patience and diligent research.

Stablecoins are a crucial development in the cryptocurrency space, offering a stabilizing force in a often volatile market. Their unique ability to peg their value to less volatile assets makes them a safe haven and a useful tool for managing financial risk in digital transactions.

- Financial Action Task Force. Virtual Assets and Virtual Asset Service Providers. Paris: FATF; 2021.

- European Securities and Markets Authority. Advice: Initial Coin Offerings and Crypto-Assets. Paris: ESMA; 2019.